Dive into the realm of digital art and explore how cryptocurrency is unlocking limitless opportunities for NFT purchases. Learn about the revolution blockchain technology is bringing to art transactions in our insightful guide. A future where art and technology intersect awaits you!

As we sail further into the digital age, two terms that have recently been stirring up a tempest are Non-Fungible Tokens (NFTs) and Cryptocurrencies. Both represent revolutionary concepts, intertwined in a dance of technology and finance, which have not only changed the way we view the digital world but also the way we interact with it.

NFTs, or Non-Fungible Tokens, are a type of digital asset created using blockchain technology, similar to cryptocurrencies such as Bitcoin and Ethereum. However, unlike most cryptocurrencies, which are fungible and can be exchanged on a like-for-like basis, NFTs are unique, with each token having a distinct value and properties. This uniqueness and ability to assign ownership to digital content has seen NFTs gain massive popularity, particularly in the realms of digital art, music, and virtual real estate. They have empowered digital creators with a new monetization method, and have blurred the boundaries between the physical and digital worlds.

Cryptocurrencies, on the other hand, are digital or virtual currencies that use cryptography for security. This makes them difficult to counterfeit and gives them a degree of decentralized control as opposed to centralized digital currency and central banking systems. Bitcoin, the first decentralized cryptocurrency, was invented in 2009 by an unknown person (or group) using the name Satoshi Nakamoto. Since then, over 4000 alternative variants of bitcoin, or altcoins, have been created. Cryptocurrencies can be used for a host of transactions over the internet, including buying goods and services, investing, and, more recently, purchasing NFTs.

The overlap between cryptocurrencies and NFTs resides within the Ethereum blockchain—the technology that underpins them. NFTs are primarily built using Ethereum protocols, and as such, they are most commonly purchased with Ether, the native cryptocurrency of the Ethereum blockchain. This intersection has given birth to an exciting new market for digital assets, one that combines the best aspects of blockchain technology—transparency, security, and decentralization—with the boundless creativity of the digital world.

For an in-depth look at some of the most popular platforms for buying and selling these digital treasures, you can explore the top NFT marketplaces to understand more about how cryptocurrencies and NFTs interact and co-exist in this space.

Understanding how to navigate the world of NFTs can seem daunting initially. However, once you grasp the process of acquiring cryptocurrencies and using them to purchase NFTs, you’ll find it’s not as complex as it sounds.

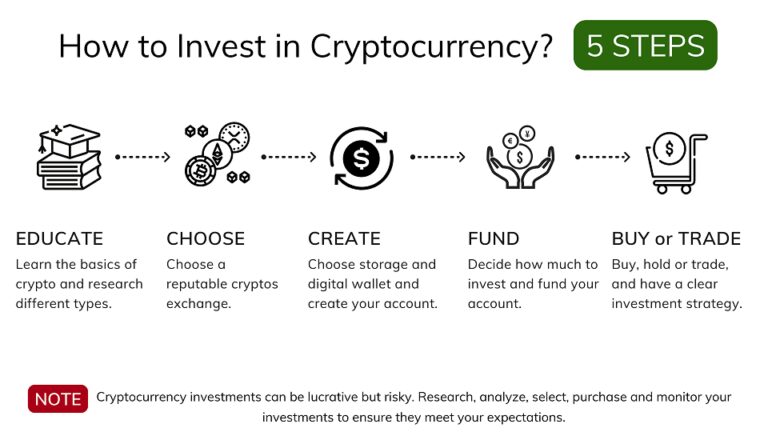

The first step in purchasing NFTs with cryptocurrencies involves acquiring the digital currency. There are plenty of digital wallets and exchanges where you can buy, sell, and store cryptocurrencies. Some of the most prominent platforms include Coinbase, Binance, and Kraken. To purchase cryptocurrency:

Once you have acquired the necessary cryptocurrency, you’re ready to buy an NFT. The following is a general step-by-step guide:

For a more detailed guide and expert advice, navigate to our NFT investing guide.

Keep in mind that transaction fees, also known as “gas fees,” apply when buying or selling NFTs. These fluctuate depending on the network congestion on the Ethereum blockchain. It’s also recommended to research carefully before buying NFTs. The market is speculative and can be risky. Invest only what you can afford to lose.

When it comes to purchasing NFTs, the marketplace you choose plays a pivotal role. In this section, we delve into some of the popular platforms that facilitate cryptocurrency payments for NFT transactions. We will explore OpenSea, Rarible, Foundation, SuperRare, Nifty Gateway, Zora, Async Art, Mintable, and Decentraland. Here’s a bit about each one:

OpenSea is one of the most comprehensive marketplaces for NFTs, supporting a vast array of digital items. You can buy, sell, and trade digital assets of all kinds, from domain names and virtual real estate to digital art and collectibles.

Rarible provides both a marketplace for NFT trading and a platform for users to create their own NFTs. It accepts Ether (ETH) for transactions, making it a popular choice for cryptocurrency enthusiasts.

Foundation is another popular marketplace that connects digital artists with collectors through the sale of unique pieces of artwork as NFTs. It uses Ethereum for transactions.

As an online art gallery of sorts, SuperRare allows artists to upload and sell their work as single-edition digital art collectibles.

Nifty Gateway acts as a centralized platform that makes it easy to buy, sell, and store NFTs. They also host Nifty drops, which are limited time sales of NFTs created by top artists.

Zora is a marketplace aiming to give more control to creators. It provides dynamic pricing for goods, meaning the price changes based on market demand.

Async Art is a unique platform that allows artists to create, sell, and collect programmable art—art that can change over time, react to its owners, or follow a stock price.

Mintable is a user-friendly platform that allows users to create, buy, and sell NFTs. It’s an excellent platform for beginners venturing into the NFT space.

Decentraland is a decentralized, virtual reality platform powered by the Ethereum blockchain. Here, users can purchase land, build upon it, and sell and trade assets. To explore a virtual journey in Decentraland, all you need to do is create an account and dive in.

While each marketplace has its own specifics, the general process of transacting NFTs with cryptocurrencies is relatively similar across platforms. Here are the standard steps to follow:

Now, you’re all set to start your journey of transacting NFTs with cryptocurrencies on these popular platforms.

The adoption of cryptocurrencies in NFT transactions offers a multitude of advantages that enhance the purchasing experience for both the buyer and the seller. Let’s delve into these benefits that might just make you want to jump onto this digital bandwagon.

Cryptocurrencies like Bitcoin and Ethereum offer a degree of anonymity that traditional banking methods don’t. By design, most digital currencies allow buyers to keep their identities secret. However, this doesn’t mean cryptocurrency transactions are untraceable. They’re recorded on the blockchain, providing a public, immutable record. But instead of names and addresses, a complex string of numbers and letters identify the parties, offering an added layer of confidentiality.

Beyond privacy, cryptocurrencies provide enhanced security for transactions. The underlying technology, blockchain, is renowned for its security features. It’s a decentralized system where each transaction is verified by a network of computers (nodes) before it’s recorded on the digital ledger. This process safeguards against fraud and makes transactions tamper-proof. For more tips on securing your investments, don’t forget to check out the NFTs security best practices.

One of the significant hurdles with traditional banking systems is the plethora of barriers they impose across different countries. Cryptocurrency payments, being borderless, offer a global access that traditional banking systems can’t. Once you have a digital wallet, you can buy, sell, and trade NFTs, regardless of your geographical location. This globalized economy allows users to engage in transactions 24/7 without worrying about banking hours or cross-border transaction fees.

Furthermore, cryptocurrencies remove the need for intermediaries like banks or credit card companies. This means that transactions can be finalized more quickly, as they don’t have to go through numerous checks and balances.

In conclusion, the use of cryptocurrencies in NFT transactions brings numerous benefits including enhanced privacy, heightened security, and increased accessibility. They help bypass traditional banking barriers, making the NFT marketplace more inclusive and accessible. While carefully weighed, these advantages make purchasing NFTs with cryptocurrencies a preferred method for many digital art enthusiasts and investors.

While using cryptocurrencies for NFT transactions offers a myriad of benefits, like most financial activities, it is not without its fair share of challenges and risks. The volatile nature of cryptocurrencies, potential for fraud, and lack of traditional consumer protection mechanisms are some of the concerns that users need to be aware of.

One of the most prominent challenges of using cryptocurrencies is their inherent volatility. Cryptocurrencies are infamous for their extreme price swings, with values that can rise or drop dramatically in a short time. This volatility can affect NFT transactions in several ways. For instance, if the value of a cryptocurrency drops significantly after an NFT purchase, the buyer could end up having paid far more for the NFT than initially intended. Similarly, a seller may receive significantly less value than anticipated if the value of the cryptocurrency they were paid in drops after the sale. This unpredictability can be daunting to users, especially those new to the world of cryptocurrencies and NFTs.

Managing the volatility of cryptocurrencies often requires a solid understanding of market trends and careful risk management. To mitigate these risks, users are usually advised not to invest more money than they can afford to lose and to diversify their cryptocurrency holdings.

An additional challenge when using cryptocurrencies for NFT transactions is the risk of fraud. Unlike traditional banking systems, cryptocurrencies operate in a decentralized manner, meaning there is no central authority overseeing transactions. This lack of regulation and oversight leaves room for possible scams and unethical behavior.

There have been instances of counterfeit NFTs being sold, and in some cases, digital artists have found their work fraudulently listed on NFT marketplaces without their consent. Moreover, since transactions made with cryptocurrencies are irreversible, there is little recourse for victims of fraud. This differs from traditional payment options where transactions can be disputed and potentially reversed.

Lack of consumer protection is another concern. Traditional financial systems have mechanisms in place to protect consumers, such as insurance on bank accounts. But in the world of cryptocurrencies, if a user loses access to their digital wallet, whether through forgetfulness or a hacking incident, they can lose all of their holdings with no way to recover them. The responsibility of safeguarding one’s cryptocurrency assets thus falls entirely on the user.

In conclusion, using cryptocurrencies for NFT transactions comes with its own set of unique challenges and risks. Users must carefully weigh these against the potential benefits before deciding to participate in this innovative market.