Dive into the exciting world of NFT investing with our in-depth guide. Whether you’re a novice or an experienced investor, our 2023 guide offers must-know tips and strategies. Learn about the fundamentals, potential risks, and advantages of investing in NFTs to boost your profit-making potential. Let’s demystify NFT investment together!

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership or proof of authenticity for an item or piece of content online. Unlike cryptocurrencies such as Bitcoin, which are fungible and can be exchanged on a one-to-one basis, each NFT has its own distinct value and properties that cannot be replicated.

The term “non-fungible” means that these tokens are not interchangeable because they contain unique information. NFTs are built using blockchain technology, predominantly Ethereum, which records the information related to the token’s ownership and authenticity. This could include digital artwork, music, virtual real estate, and even tweets. A good analogy for NFTs would be the uniqueness of a signed autograph.

NFTs operate on the principles of cryptography and blockchain technology. Essentially, when an NFT is created, or ‘minted,’ it is added to a blockchain, where unique information is recorded about the asset. This includes the digital signature of the creator, ownership history, and any other relevant metadata. This process ensures the token’s authenticity and the impossibility of counterfeiting or duplicating it.

Unlike regular cryptocurrencies, NFTs are indivisible; they exist as a whole item, which means you can’t buy or own a fraction of an NFT – it’s all or nothing.

The value of NFTs lies in their uniqueness and the demand for them. In other words, an NFT’s worth is largely subjective and determined by what someone is willing to pay for it. For example, digital artist Beeple’s artwork sold as an NFT for a staggering $69 million.

There is a sense of ownership and scarcity created with NFTs, which can make them attractive to collectors and investors. Like owning an original painting, owning an NFT gives the holder the bragging rights of ownership, even if the digital asset itself can be duplicated or shared online.

Uncover more about this exciting digital frontier by diving into NFTs: A New Wave of Digital Assets.

Non-fungible tokens (NFTs) and cryptocurrencies share a fundamental relationship as they both leverage the power of blockchain technology. While cryptocurrencies represent a medium of exchange, NFTs are unique digital assets that represent ownership of a particular item or piece of content. This section delves deeper into the interconnection between NFTs and cryptocurrencies, discussing how the blockchain technology powers NFT transactions and which cryptocurrencies are typically used in these transactions.

At the core of every NFT transaction is the blockchain, a decentralized and distributed digital ledger that records transactions across many computers. This technology provides transparency, security, and immutability, crucial qualities that make NFTs possible and reliable. Every NFT transaction is recorded on the blockchain, verifying the ownership and authenticity of the digital asset. This ensures that each NFT is unique and cannot be replicated, adding to its value and appeal. For more in-depth information about how blockchain powers NFT transactions, consider reading the article Blockchain: The Backbone of NFT Transactions.

NFT transactions typically require a specific type of cryptocurrency. The most commonly used cryptocurrencies for NFT transactions are Ethereum (ETH), Binance Coin (BNB), Flow, and Tezos (XTZ), among others.

It’s essential to note that the choice of cryptocurrency often depends on the particular NFT marketplace, as different platforms support different blockchains and cryptocurrencies. Therefore, those interested in entering the NFT market need to familiarize themselves with the cryptocurrencies accepted on their platform of choice.

The world of non-fungible tokens, or NFTs, presents an exciting frontier for investors who are comfortable with a high level of risk and potential for sky-high returns. Yet, like any investment opportunity, NFTs come with their own unique set of challenges and considerations. In this section, we unpack the potential returns, risks, and volatility of NFT investing.

The potential returns on NFTs can be astronomical. The key driver behind these returns has been a dramatic increase in demand for NFTs, fueled by the digitalization of art, games, music, metaverses, and other forms of creative expression. The record-breaking sale of Beeple’s artwork for $69 million at Christie’s auction is a classic testament to the potential high returns of NFT investments.

However, it’s essential to remember that not all NFTs will yield such phenomenal returns. The NFT market can be unpredictable, and values can fluctuate wildly based on various factors like the popularity of the creator, the uniqueness of the NFT, and market trends. Therefore, prospective investors must conduct thorough research and comprehensive analysis before venturing into NFT investments.

While the NFT market oozes potential, it’s also fraught with significant risks and volatility. The value of an NFT is highly subjective and can change rapidly, causing potential losses to investors.

There are several reasons for this volatility:

Therefore, while NFT investments can offer substantial returns, they also pose considerable risks. To successfully navigate this fluctuating market, investors need to stay abreast of market trends, conduct thorough due diligence, and never invest more than they can afford to lose.

If you’re considering making an investment in the NFT market, our guide on Navigating the Volatile Waters of NFT Investing provides a comprehensive overview of the challenges you may face and strategies to overcome them. While the potential rewards can be significant, navigating the unpredictable world of NFTs requires careful planning, strategic thinking, and a strong stomach for risk.

The rise in popularity of Non-Fungible Tokens (NFTs) has led to the emergence of various marketplaces where enthusiasts can buy and sell these unique digital assets. Among these platforms, some have distinguished themselves for their service, security, and user base. This section will provide an overview of popular NFT marketplaces and a step-by-step guide on navigating these platforms.

Multiple platforms have gained repute in the NFT space. Some of the top marketplaces include Bitsler, Roobet, BC GAME, 22bet, and Fortunejack.

Choosing the right marketplace depends on your preferences, the type of NFTs you’re interested in, and your chosen payment method. For a comprehensive comparison of these platforms, consider visiting Exploring the Top NFT Marketplaces.

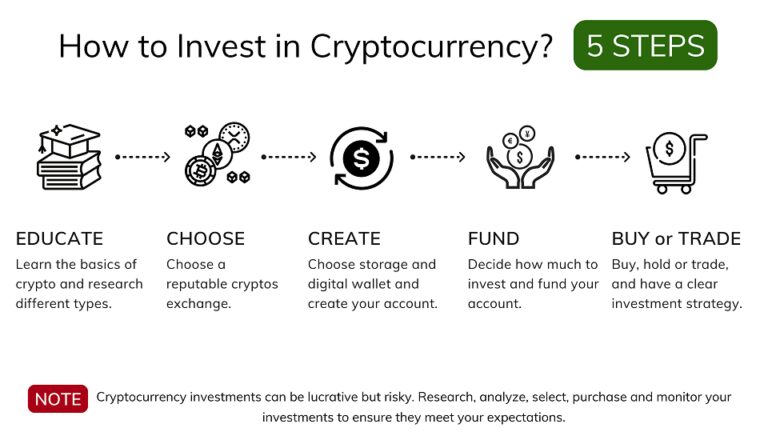

Whether you’re an experienced crypto enthusiast or a beginner, buying and selling NFTs involves a set of steps to ensure a successful transaction. Here’s a general guide:

This guide covers the basic steps, but remember that each platform might have specific procedures or requirements. Ensure to familiarize yourself with them and happy trading!

In recent times, Non-Fungible Tokens (NFTs) have emerged as digital assets holding promising investment potentials. Numerous individuals and organizations have identified and leveraged this potential to make impressive gains. Let’s take a dive into some notable instances of successful NFT investments and evaluate what made these transactions successful.

One of the most remarkable triumphs in NFT investment history has to be the sale of a digital artwork named ‘Everydays: The First 5000 Days.’ The creator, the digital artist Beeple, made an unprecedented sale of his work as an NFT on Christie’s auction house for a staggering sum of $69 million.

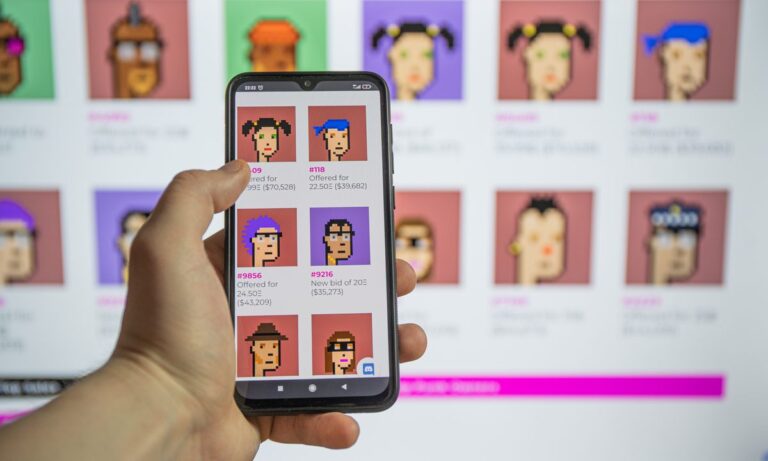

Another widely celebrated success is the sale of ‘CryptoPunk #7804.’ CryptoPunks are a series of 10,000 uniquely generated characters. No two are exactly alike, and each one of them can be officially owned by a single person on the Ethereum blockchain. CryptoPunk #7804, one of these virtual characters, was sold for 4200 Ether, approximately $7.5 million.

These examples set the stage for further exploration into successful NFT investments. In addition, they give an insight into the high-profit potential of NFTs and the possibility of generating substantial returns.

It’s clear from these examples that successful NFT investments have certain commonalities. The first is rarity: both Beeple’s artwork and CryptoPunk #7804 are unique, with no identical copies available, making them highly desirable.

Another factor is the perceived value of the NFT. The NFT market, like the art market, is largely subjective. An NFT’s value is determined by how much someone is willing to pay for it, which can vary dramatically. Buyers were willing to pay millions for the ownership of Beeple’s digital artwork and CryptoPunk #7804 because they perceived them to be of high value.

The creators’ reputation also plays a significant role. Beeple, for instance, already had an established reputation as a digital artist. This reputation can increase buyers’ confidence in an NFT’s value, leading to higher profits from sales.

To learn more about successful NFT investments, check out our comprehensive guide titled From Memes to Millions: Successful NFT Investments.