Dive into the intricate world of cryptocurrency regulations in Africa with our comprehensive guide. Remain informed, compliant, and triumphant in your crypto journey by understanding the complex regulatory landscape of this emerging market.

The advent of cryptocurrency has not only transformed the global financial landscape but has also posed new regulatory challenges for authorities worldwide. Africa, a continent well-known for embracing technological innovation, is no exception. This section aims to provide an overview of the cryptocurrency regulations in Africa, considering why understanding these laws is crucial for users and businesses alike.

Across Africa, regulatory responses to the rise of cryptocurrencies have varied greatly. Some countries, like South Africa, have been proactive in their approach, setting forth guidelines for businesses that work with digital assets. Others, such as Africa, have adopted a more cautious stance, warning their citizens about potential risks, while in other nations like Algeria, cryptocurrencies are entirely banned. This variety of approaches demonstrates the complexity of creating overarching regulations for a rapidly evolving industry like crypto.

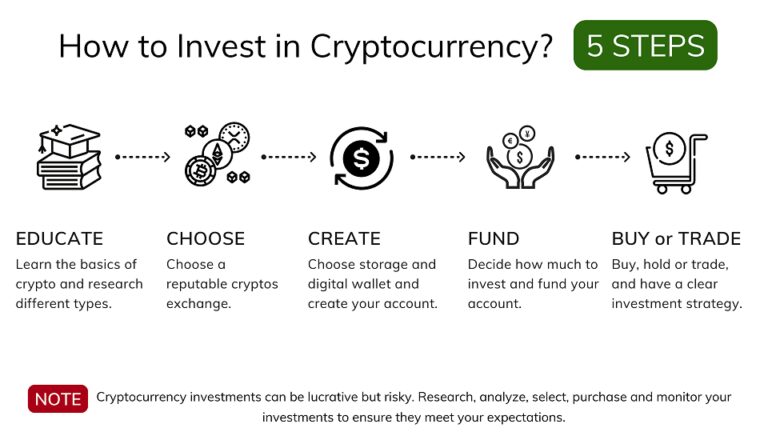

For both individual users and businesses, a thorough understanding of cryptocurrency regulations is essential. Enterprises dealing in cryptocurrencies need to be aware of legal ramifications, including taxation obligations and disclosure requirements. For individual users, understanding these laws can help mitigate risks and assist in making informed investment decisions.

The regulatory environment significantly influences the cryptocurrency market’s growth and development in Africa. For instance, countries with clear and favorable crypto regulations can potentially attract more blockchain startups, boosting economic development in the process. Conversely, more stringent or unclear regulations can hinder growth, causing potential investors to hesitate due to the perceived risk.

One sector significantly influenced by cryptocurrency regulations in Africa is online betting. For a more comprehensive understanding, you can refer to our guide on the Best Crypto Betting Practices. This guide explores the relationship between crypto regulations and online betting, providing you with best practices to ensure that your betting experiences are safe, enjoyable, and above all, legal.

The legal status of cryptocurrencies in Africa tends to fluctuate, with varying degrees of regulation across different countries. As the continent continues to grapple with the delicate balance between embracing innovation and protecting consumers, there’s a clear need for a comparative analysis of cryptocurrency regulations in various African countries such as South Africa, Nigeria, Africa, and beyond.

In South Africa, cryptocurrency is not considered legal tender, but it’s not illegal either. The country’s authorities have issued warnings about potential scams but have yet to impose hard-and-fast rules regarding its use. Nigeria, on the other hand, has taken a tougher stance. The Central Bank of Nigeria issued a directive in 2021 forbidding banks and other financial institutions from dealing with or facilitating transactions for crypto exchanges. Meanwhile, in Africa, while cryptocurrencies are not considered legal tender, there isn’t a specific law banning their use, creating a sort of regulatory gray area.

Some African nations have embraced cryptocurrencies, while others have outright banned it, and others still have yet to adopt any official stance. Let’s delve deeper:

These regulatory variations across the continent directly impact cryptocurrency platforms like Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, and Vave. These platforms have to navigate a complex and evolving regulatory landscape – adopting strategies to comply with existing regulations in some countries while pushing for regulatory reforms in others.

How these regulations affect the burgeoning crypto betting industry is a topic worth exploring. A deeper dive into the Impact of Football on Crypto Betting provides detailed insights into this topic, taking into account the popularity of football in Africa and its influence on the local betting activities.

Cryptocurrency regulations, or the lack thereof, can significantly affect the economic landscape in African countries. Governments, businesses, and consumers in Africa need to be aware of the potential impact these regulations can have on the economy.

When governments implement regulations on cryptocurrencies, it can lead to a range of economic effects. For one, regulations can increase the stability and trustworthiness of the cryptocurrency market, making it a more attractive investment option. They can also encourage more businesses to adopt cryptocurrency payment methods, potentially boosting economic activity.

Regulations can play a vital role in promoting the growth of blockchain technology and innovation in Africa. They can provide a framework that protects consumers and businesses, while also supporting innovation and growth in the blockchain industry.

For example, regulations can ensure that blockchain companies operate in a fair and transparent manner, which can increase trust in the technology and encourage more businesses and consumers to adopt it. Additionally, regulations can help attract foreign investment in Africa’s blockchain industry, which can lead to economic growth and job creation.

Several countries in Africa have seen benefits from implementing cryptocurrency regulations. For instance, South Africa has implemented regulations to combat fraud and money laundering, leading to an increase in trust and adoption of cryptocurrencies.

In Nigeria, the central bank has issued guidelines for cryptocurrency use, resulting in a boost to the local fintech sector. The country is now a leading player in Africa’s cryptocurrency market, with a growing number of businesses accepting cryptocurrency payments.

One of the most exciting trends in the world of cryptocurrency is the rise of the Metaverse. This virtual reality space, where users can interact with a computer-generated environment and other users, is becoming increasingly integrated with cryptocurrency.

Transactions in the Metaverse often rely on cryptocurrency, and some Metaverse projects even have their own digital currencies. As such, the trend of the Metaverse could have significant economic implications for countries in Africa. To learn more about this trend, check out our comprehensive guide on Understanding the Metaverse Trend.

Understanding and maneuvering through the regulations surrounding cryptocurrencies in Africa can be a daunting task for both individual users and businesses. The legal framework that governs the use of cryptocurrencies varies greatly across the continent, and it is essential to be versed with these regulations to avoid any legal complications and to make the most out of your cryptocurrency investments.

Individual users should be keen on comprehending the regulatory environment that governs the use of cryptocurrencies in their particular jurisdiction. This is important as it not only helps in avoiding any potential legal pitfalls but also in understanding the rights and protections available to you as a user. Here are key points to consider:

For businesses, navigating cryptocurrency regulations might be more challenging due to the additional layers of complexity introduced by factors such as operational scale, business transactions, and the potential for larger legal implications. Here are some key considerations:

Converting your cryptocurrency assets into cash is often a key aspect of using digital currencies. However, it can also be a process fraught with risks, including financial loss and potential legal issues. To help you navigate this process safely, a comprehensive guide has been created, providing key tips and strategies. You can access the guide to converting crypto to cash safely here.

In Africa, cryptocurrency holds immense potential as a catalyst for improving financial inclusion and reshaping existing economic structures. However, the region’s journey into the realm of cryptocurrency is riddled with numerous challenges and uncertainties. In this section, we explore some of these challenges, alongside the abundant opportunities available for both investors and businesses in the African cryptocurrency landscape.

The widespread adoption and regulation of cryptocurrency in Africa are hindered by a variety of factors such as absence of comprehensive legal frameworks, inadequate infrastructure, and limited understanding of the concept. Let’s delve into these challenges.

Despite the challenges, the African cryptocurrency landscape also presents a plethora of promising opportunities ready to be harnessed for economic growth and development. With the right regulations in place, these opportunities can significantly transform the continent’s financial ecosystem.

With adequate education, strong infrastructure, and robust regulations, Africa’s vast potential for cryptocurrency can be fully realized, opening up a wealth of opportunities for the continent’s economies and its people.