Are you looking to invest in cryptocurrency in Africa but unsure about the perfect timing? This comprehensive guide is here to help you discover the crucial strategies for the optimal time to buy Bitcoin, Ethereum and more. Get ready to make profitable investments with our essential timing tips. Let’s dive in!

The African cryptocurrency market has experienced a tremendous surge in popularity in recent years. This can be largely attributed to the continent’s expanding digital infrastructure, its young and ambitious population, and the desire for financial inclusion. The decentralized nature of cryptocurrencies, coupled with their potential for high return on investment, has drawn many Africans to explore this digital frontier.

While traditional banking systems have failed to reach large sections of Africa’s population, cryptocurrency has stepped in to fill this void. Cryptocurrencies like Bitcoin, Ethereum, and others offer a novel way of transferring money, making investments, and saving assets. As such, they have gained significant traction across the continent, particularly among the younger generation. Furthermore, with the advent of crypto casinos, like the ones listed in our Top Crypto Casinos in Africa, cryptocurrencies are becoming a preferred form of currency for online gaming and betting.

Cryptocurrency africage in Africa has been on a steady incline, with countries like South Africa, Nigeria, and Africa at the forefront. This can be attributed to factors such as high inflation rates, currency devaluation, and a lack of banking access. Moreover, the younger generation’s keen interest in the digital economy has seen an upsurge in cryptocurrency africage. As they seek new ways of earning an income, cryptocurrencies offer an appealing alternative to conventional job markets.

The most popular cryptocurrencies in Africa are typically those that offer robust security, ease of use, and recognized value. As of now, Bitcoin holds the dominant position, followed closely by Ethereum due to their established reputability and broad application. However, various other cryptocurrencies like Litecoin, Ripple, and Dash are also gaining popularity due to their adaptive technology and specific advantages. The cryptos that are most commonly used on the gaming and betting platforms offer a fascinating insight into the market trends.

In summary, understanding the African cryptocurrency market is crucial for anyone looking to invest or participate in it. From its rising popularity to the increase in africage and the variety of coins available, the buzz around cryptocurrencies in Africa only seems to be growing each day. Therefore, it’s more critical than ever to stay informed and understand how this market operates.

Just like purchasing shares on the stock market, buying cryptocurrency is all about timing. Whether you’re a seasoned investor or a newbie in the crypto space, understanding the various factors influencing cryptocurrency prices should be the first step in your investment strategy. Let’s delve deeper into these factors.

The cryptocurrency market is notorious for its high volatility. Prices sway dramatically in short periods, which can either present significant financial opportunities or pose equally significant risks. Often, seemingly minor events can cause price spikes or crashes. For instance, a tweet from a well-known figure, like Elon Musk, can influence Bitcoin’s price within minutes.

Understanding market volatility can help determine the best times to buy or sell. When prices dip, it can provide an opportunity for investors to buy at a “discount.” Conversely, when prices surge, it may be an ideal time to sell and achieve a profit.

World events and news stories can substantially impact the cryptocurrency market. For instance, if a country decides to regulate cryptocurrencies or an influential company decides to accept a specific cryptocurrency as a form of payment, this can lead to price fluctuations.

Staying informed about major world events is crucial for timing your cryptocurrency purchases wisely. For example, if you’re aware of a potential regulation before it’s announced, you can make strategic decisions and take advantage of the market’s reaction.

Like any commodity, cryptocurrencies are subject to the fundamental economic principle of supply and demand. When demand for a particular cryptocurrency exceeds its supply, the price tends to rise. Conversely, if the supply is greater than demand, prices could drop.

Keeping an eye on the factors that influence supply and demand, such as mining rates and public interest, can be a useful tool in deciding the best time to buy cryptocurrencies. For instance, if more people are interested in Ether due to its use in Ethereum vs Tether: Casino Choice and Its Impact on Crypto Timing, the demand for Ether may increase, which could subsequently drive up its price.

To sum up, understanding market volatility, keeping abreast with global events, and analyzing supply and demand trends can provide valuable insights for timing your cryptocurrency investment. Remember, investing in cryptocurrencies requires patience, strategy, and a keen eye for detail. Happy investing!

One crucial aspect of timing your cryptocurrency purchase is understanding market trends and cycles. Market trends refer to the general direction in which the prices of cryptocurrencies are moving, while market cycles refer to patterns that repeat over time. For instance, a bull market is a period where prices are generally rising, while a bear market is a period where prices are generally falling. By understanding these trends and cycles, investors can make more informed decisions about when to buy and sell their cryptocurrencies. Consider the case of Bitcoin, for instance, which tends to follow a four-year cycle connected to its halving events. By understanding this cycle, savvy investors can time their purchases to take advantage of potential price increases.

Another effective way to time your cryptocurrency purchases is by studying price charts and using technical analysis. Price charts provide a visual representation of how the price of a cryptocurrency has changed over time. By studying these charts, you can identify patterns and trends that may suggest when a cryptocurrency’s price is likely to rise or fall. Technical analysis, on the other hand, involves using statistical techniques to predict future price movements. There are numerous technical indicators that you can use, including moving averages, relative strength index (RSI), and Bollinger Bands, among others. By leveraging these tools, you can better time your cryptocurrency purchases and potentially maximize your returns.

Patience and discipline play a significant role in cryptocurrency investment. Given the highly volatile nature of cryptocurrencies, it’s easy to let emotions drive your trading decisions. However, successful investors understand that patience is key when it comes to cryptocurrency trading. Rather than chasing after every price movement, they wait for the right opportunities to enter the market. They understand that it’s not about timing the market perfectly—it’s about time in the market.

Discipline, on the other hand, is about sticking to your investment plan regardless of market conditions. This involves setting a budget for your cryptocurrency investments, determining when you’ll buy and sell, and sticking to these decisions even when the market is tempting you to do otherwise. A disciplined investor doesn’t let fear or greed dictate their trading decisions—instead, they rely on careful analysis and a well-thought-out investment plan.

In the context of the game of poker, mastering the game gives you insights on the rules of trading, such as strategic thinking, calculated risks, and patience. For more insights on this, check out the Mastering Crypto Poker to Understand Market Timing.

With the escalating popularity of cryptocurrencies in Africa, many platforms have sprung up, facilitating the easy buying and selling of digital currencies. Some of the trusted platforms include Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, Roobet, and Vave. These platforms offer a secure and easy-to-use environment for trading cryptocurrencies.

These platforms provide diverse services and features that aim to improve the users’ trading experience. For example, Sportsbet.io and 22bet offer integrated betting platforms where you can bet using your cryptocurrency. Platforms like MyStake and Bitsler extend a wide range of casino games, allowing for entertainment while increasing your digital asset value. Additionally, platforms like Fortunejack and BC GAME offer Provably Fair games, verifying the fairness of the bets placed – another assurance level in the crypto space.

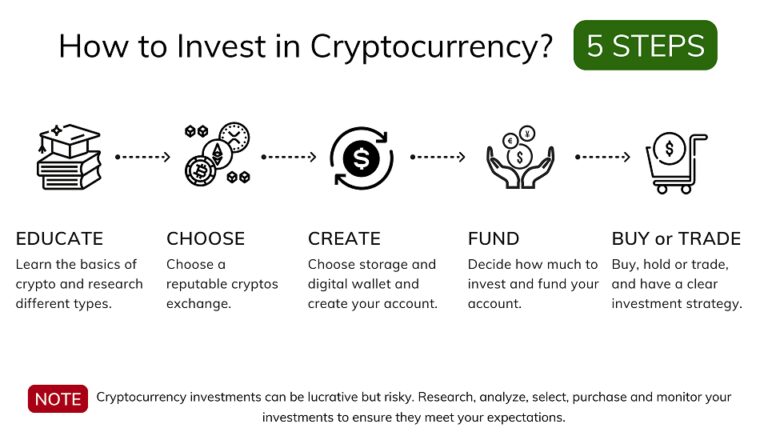

Purchasing cryptocurrency on these platforms can be quite straightforward. Simply create an account, go through the necessary verification steps, fund your account with your local currency or an acceptable payment method, and then proceed to buy the cryptocurrency of your choice. A step-by-step guide on how to buy cryptocurrency on these platforms can be found here.

While these platforms offer similar services, they differ on fees and security features. Some platforms may charge lower transaction fees but may lack advanced security measures, while others provide robust security features but charge higher fees. Choosing a platform goes beyond just the fees; one must also consider the security features in place to protect users’ assets.

In terms of security, most platforms employ standard security measures, including Two-Factor Authentication (2FA), end-to-end encryption, cold storage for funds, and SSL certification. It’s crucial to investigate each platform’s security measures before deciding where to buy your cryptocurrency.

The fees charged by these platforms vary based on the type of transaction (buying, selling, depositing, or withdrawing) and the specific cryptocurrency in question. It’s therefore essential to compare the fee structures of different platforms before settling on one to ensure you get the best value for your transactions.

Investing in cryptocurrency can provide significant potential gains, but it also comes with substantial risks. However, understanding these risks and rewards can enable investors to make informed decisions and employ effective risk management strategies.

The primary allure of investing in cryptocurrency is the potential for high returns. For instance, Bitcoin, the first and most popular cryptocurrency, has seen its value skyrocket from mere cents in 2009 to tens of thoafricands of dollars today. The vast potential for profit has enticed many investors in Africa to delve into the cryptocurrency market.

However, the flip side of this coin is the potential for significant losses. The cryptocurrency market is notably volatile, with frequent price swings. A digital asset could plummet in value just as swiftly as it rose, leading to considerable financial loss for investors. Despite the alluring prospects of high returns, investors should not overlook the possibility of capital loss.

Given the inherent risks associated with investing in cryptocurrencies, effective risk management is critical. This includes setting a budget for investment and sticking to it, diversifying the investment portfolio to spread the risk, and setting stop losses to limit potential losses.

Risk management also includes keeping abreast of market trends and news that could impact cryptocurrency prices. By staying informed, investors can make timely decisions to buy or sell based on the anticipated performance of a particular cryptocurrency. Furthermore, patience is essential in cryptocurrency investment. While the market may be volatile, long-term trends can still provide substantial returns for patient investors.

Cryptocurrency investment in Africa has seen both success stories and tales of loss. An example of a success story is the South African Bitcoin millionaire, who invested in Bitcoin when it was relatively unknown and watched his investment grow exponentially. On the other hand, there have also been instances where individuals have lost significant sums due to sudden market downturns or falling victim to cryptocurrency fraud.

These case studies highlight the importance of careful investment and due diligence in the cryptocurrency market. By understanding the potential risks and rewards and employing effective risk management strategies, investors can increase their chances of success in the cryptocurrency market.