are transforming the financial sector in remarkable ways. This 2023 guide offers you a deep dive into the universe of digital currency lending, spotlighting the top platforms in the industry. Learn about their unique benefits and how they present a revolutionary approach to finance. Start exploring now!

The world of finance has seen a significant shift with the advent of cryptocurrencies. One exciting development in the cryptocurrency space is the emergence of Crypto Lending Platforms. But what exactly are they?

Crypto Lending Platforms are digital platforms that allow for transactions involving cryptocurrencies as loans. They operate on blockchain technology, ensuring secure, transparent, and quick transactions. These platforms enable owners of digital currencies to lend their assets to others in exchange for interest. The borrower, in turn, provides crypto assets as collateral to secure the loan.

There are numerous benefits to using Crypto Lending Platforms, including:

Like any other investment, crypto lending also carries certain risks:

Given the pros and cons, it’s essential to tread carefully in the crypto lending space. If you are also interested in sports betting with crypto, you might want to Discover the Best Crypto Betting Platforms.

Remember, the key to managing risks and maximizing returns in crypto lending lies in understanding the platform’s functionality, the associated benefits, and the potential risks. It’s crucial to educate oneself and stay updated with the latest news and trends in the crypto world.

Given the booming popularity of cryptocurrencies, a myriad of crypto lending platforms has sprouted to cater to the needs of savvy crypto enthusiasts. Here, we will dive into some of the most notable players in the crypto lending space, including Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, Vave, Freshbet, Velobet, and 0x.bet.

Each of these platforms has its unique offerings that make it stand out within the crypto lending industry. For example, Bitsler is known for its community-focused approach and an extensive range of games, while MyStake offers a number of sports betting options with exciting promotions and bonuses. Sportsbet.io is hailed for its fast deposits and withdrawals in addition to an impressive selection of betting markets. 20Bet, on the other hand, is admired for its vast variety of casino games and sports betting options.

Rolletto and Stake are other commendable platforms in the space, offering a blend of casino games, live betting, and esports. Meanwhile, 22Bet and Megapari have won the hearts of users with their easy user interface and diverse payment methods, including a wide range of cryptocurrencies. Fortunejack and Thunderpick stand out with their robust security protocols, wide crypto support, and a multitude of gaming and betting options.

Trust Dice and Roobet are popular for their provably fair games, while BC Game offers a host of unique features like a chatroom where users can earn free tokens. Platforms such as Vave, Freshbet and Velobet are praised for their generous bonuses, wide variety of games and extraordinary customer service. Lastly, 0x.bet is known for its smart contract-based operations, providing users with an added layer of trust and security.

In addition to these general characteristics, each platform stands out with its unique features and benefits. With the rapidly evolving crypto market, these platforms keep adding new features and improving their services to remain competitive. To understand why these platforms are gaining popularity, let’s delve into the special features of each.

For more insights on how crypto and esports are converging in interesting ways, check out this article on Crypto and Esports Scholarships – A New Trend.

To sum up, these platforms provide a plethora of services and features enabling the users to engage in the crypto space in various ways. Each platform’s unique characteristics and benefits cater to different needs, making it essential for users to understand each platform’s offerings before making a choice.

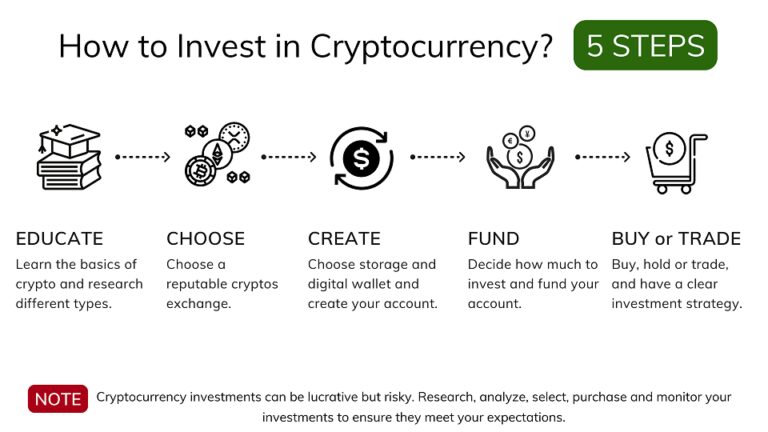

Using crypto lending platforms may seem complex at first glance, especially for those just stepping into the crypto realm. However, with a thorough understanding, you would realize it’s quite straightforward. Below is a step-by-step guide on how to start using these platforms. Alongside, you’ll also find some useful tips for choosing the right platform based on your personal needs and investment goals.

Setting up an account is typically the first step towards using a crypto lending platform. This would require providing some personal information and going through a verification process to ensure maximum security. After successful registration, you can deposit your cryptocurrency into your account on the platform. Remember that each platform has different accepted cryptocurrencies, so ensure the one you wish to deposit is accepted.

Next is choosing the loan type according to your needs. Platforms typically offer margin loans and secured loans. Margin loans allow you to borrow funds to trade and secure more assets, while secured loans provide you with fiat or stable coins in exchange for your deposited crypto. After choosing the type, you can set your loan terms. These include duration, interest rate, and loan amount.

Upon setting your loan terms, the platform matches you with a lender. If the lender agrees with your terms, the loan is disbursed to your account. It’s crucial to honor the loan agreement to maintain a good credit history on the platform.

Each crypto lending platform hosts distinct features tailored to various needs. Therefore, a platform that works for one person may not necessarily work for another.

To further guide beginners in making the right decision, our Affordable Crypto Choices for Beginners provides a comprehensive list of cryptocurrencies suitable for those new to the digital currency market. It serves as an excellent resource to make informed crypto investment decisions, and could be particularly useful when deciding which crypto assets to deposit for use on a crypto lending platform.

To anyone new to the world of cryptocurrency lending platforms, the intricate details of interest rates and loan terms can appear a bit baffling. But worry not, this section will help demystify these important aspects of crypto lending and ensure that you are well-prepared to navigate the crypto lending seas.

Quite different from banks, cryptocurrency lending platforms have a unique way of determining interest rates. Generally, these are influenced by factors such as the supply and demand of certain cryptocurrencies, the creditworthiness of the borrower, collateral type, loan term, the overall volatility of the crypto market, among others. The more volatile a cryptocurrency, the higher the interest rate tends to be. It’s essential to understand that the interest rates can fluctuate due to these various market forces and hence, investors should always stay updated with the latest news and trends. For a broader overview of the rules and regulations governing the crypto lending sphere, you might find our Comprehensive Guide to Crypto Regulations helpful.

Loan terms and conditions are key elements that dictate the length of the loan, the interest rate, the repayment schedule, and possible penalties for late or missed payments. In the crypto lending space, these terms can vary widely from one platform to another. Therefore, before engaging with any platform, it’s crucial to diligently review the terms and conditions to ensure they align well with your investment strategy.

Here are some points to consider when understanding loan terms on crypto lending platforms:

Remember, the secret to successful crypto lending lies in understanding these underlying principles. Should you require further information on the ins and outs of different lending platforms, terms, conditions, and interest rates, always refer to the respective platform’s information source or consult a financial advisor.

As the popularity of crypto lending platforms continues to surge, the security of these platforms has become a paramount topic of discussion. Just like any other online financial platform, crypto lending sites are prone to potential security threats such as hacking, phishing, and other forms of cyberattacks. Therefore, it is crucial for users to understand how these platforms protect their data and digital assets. To offer insights into this, this section will provide an overview of common security protocols on crypto lending platforms.

Crypto lending platforms aim to ensure the safety of their users’ funds and personal information by implementing various security measures and protocols. Some of the most common include:

It’s not enough to simply implement these security measures. Platforms are also obligated to maintain and upgrade their security apparatus regularly in response to evolving threats. Regular security audits, system checks, and user education are all critical to a robust protection scheme.

When it comes to safeguarding digital assets, platforms often work with trusted custodial services, guaranteeing an extra layer of security. These custodial services are insured, providing further assurance to users should any unlikely losses occur. Also, many platforms have stringent withdrawal processes to ensure only the rightful owner of an account can extract funds.

For user data, platforms adopt robust data protection and privacy policies in compliance with global standards. These policies stipulate exactly how user data is collected, stored, and used, and platforms are bound by strict penalties for breaches.

In conclusion, while crypto lending platforms offer a new frontier for investors, it’s absolutely crucial to consider their security measures before getting involved. Ensure the platform you choose has a robust security protocol and a proven track record of protecting its users’ data and digital assets.