Dive into the world of cryptocurrency and discover powerful ways to convert your digital assets into cash in Africa. This blog post will equip you with successful strategies to unlock the full potential of your cryptocurrency and elevate your financial game. Explore the future of finance now!

The rise of cryptocurrency in Africa has been nothing short of dramatic. As the digital world continues to evolve, Africa has experienced a significant inflow of this novel form of money. Technological advances, coupled with the need for accessible and inclusive financial systems, have led to a surge in the interest and use of cryptocurrencies across the continent.

The African continent has seen a meteoric rise in the adoption of cryptocurrencies. Factors such as high inflation rates, unstable local currencies, and the large unbanked population have led to a significant increase in cryptocurrency use. African residents have turned to digital currencies as a reliable and convenient alternative to traditional banking methods, fostering the birth of a new digital financial landscape.

As an integral part of the continent’s booming tech sector, cryptocurrencies play a crucial role in Africa’s economy. They offer an efficient and reliable means of money transfer, allowing for seamless cross-border transactions and increased financial inclusion. Cryptocurrencies also provide a platform for entrepreneurial innovation, driving growth in the tech industry and paving the way for a digital economic revolution.

Despite the exponential growth and popularity of cryptocurrency, its legal status in Africa remains a bit of a gray area. Some countries have embraced the technological innovation, while others have imposed bans or restrictions. The varying responses from governments across the continent reflect the complexities and challenges posed by these digital currencies. For a comprehensive explanation of this, check out our in-depth Guide to Cryptocurrency Regulations in Africa. It provides an overview of the regulatory landscape and offers country-specific details on crypto laws and guidelines.

Understanding this landscape is crucial, not only for prospective investors and tech-enthusiasts but also for policymakers and regulatory bodies. It sets the stage for effective policy-making and legal frameworks that accommodate the growth of cryptocurrency, while mitigating potential risks.

Cryptocurrency has taken the world by storm, forging a new pathway for financial transactions. While cryptocurrencies come with myriad advantages, many people still struggle with the process of converting their cryptocurrency into cash. Let’s walk through this process, understanding its nuances, and its significance.

Essentially, the process of converting cryptocurrency to cash involves selling your cryptocurrency on a digital marketplace or exchange, and then withdrawing your cash to your bank account. Some cryptocurrencies can also be converted directly into prepaid credit cards, which can then be used like regular credit cards.

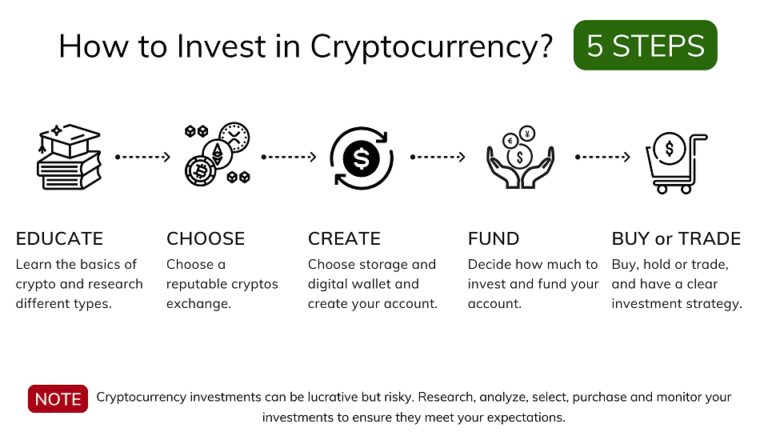

There are a few vital steps involved in the conversion process:

Cryptocurrency exchanges serve as intermediaries in the conversion process. They allow users to convert one cryptocurrency to another, or to convert cryptocurrency into fiat currency and vice versa. Some of the popular cryptocurrency exchanges include Coinbase, Binance, and Kraken. These exchanges facilitate transactions while ensuring a level of security and transparency.

When it comes to cryptocurrency transactions, security is paramount. Cryptocurrencies are susceptible to hacking and fraud, hence the need for reliable and secure platforms for transactions. These platforms should have robust security mechanisms, including two-factor authentication, encrypted transactions, and secure wallets.

In addition to security, the platform should also offer a user-friendly interface, efficient customer service, and reasonable transaction fees. It should also align with the regulations in your region to avoid any legal complications. You can find some of the Best Crypto Betting Platforms here, which not only offer secure transactions but also a seamless user experience.

The African continent offers a broad spectrum of platforms for the conversion of cryptocurrency to cash. These platforms cater to different needs and preferences, with each offering unique features and benefits. Here, we will review some of the popular platforms on the continent, including Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22Bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, and Vave.

Bitsler is a crypto-enabled gaming platform that allows users to convert cryptocurrencies to cash. On the other hand, MyStake offers a convenient and intuitive platform for users to effortlessly exchange their cryptocurrencies for money.

Sportsbet.io allows gamblers to bet with cryptocurrencies, while also enabling them to convert their winnings into cash, offering a seamless process that is greatly appreciated by users. Similarly, 20Bet and Rolletto offer crypto-enabled gambling with easy conversion to cash.

On the other hand, Stake, 22Bet, and Megapari focus on sports betting, casino games, and e-sports. They are all crypto-enabled, ensuring ease of cryptocurrency conversion. Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, and Vave offer diversity in gaming and betting, catering to different users’ interests and ensuring efficient conversion of cryptocurrencies to cash.

Choosing the right platform for converting cryptocurrency to cash is essential. Users need to consider a variety of factors, including:

For more on making affordable choices in the world of digital currencies, check out our Affordable Cryptocurrency Choices guide. It offers insight into making the right decisions based on budget and needs, ensuring that you make the most of your cryptocurrency investments.

When it comes to converting cryptocurrency to cash, understanding and navigating exchange rates and fees is crucial. Exchange rates between cryptocurrencies and fiat currencies can be volatile and can significantly impact the value of your conversion. It’s essential to monitor these rates closely and make conversions when rates are favorable. Various online tools and platforms can assist with this.

Furthermore, most cryptocurrency exchange platforms charge fees for transactions. These fees can be a fixed amount or a percentage of the transaction value. Hence, comparing the fee structures of different platforms is an effective way to minimize costs. Some platforms may offer lower fees for higher trading volumes, so it might be worth consolidating your transactions.

Converting cryptocurrency to cash is not instantaneous. It requires a process involving various steps, each with its timeline. The speed of conversion depends on factors such as the cryptocurrency in question, the exchange platform, and even the specific type of transaction. For instance, larger transactions may take longer due to additional security checks.

Understanding these processes and their timelines can help you plan accordingly and avoid unnecessary delays. Different platforms may have different processing times, so be sure to take this into consideration when choosing a platform.

The conversion of cryptocurrency to cash involves several security risks, including hacking and fraud. Therefore, it’s crucial to take measures to ensure the safety of your funds during this process. This could involve using secure and reliable platforms, enabling two-factor authentication, and regularly updating your security settings.

Always ensure that your chosen platform complies with all necessary security standards and has robust security measures in place. It’s also advisable to use platforms that have an excellent track record and positive reviews for their security measures. For more detailed information on this topic, consult our Tips for Converting Cryptocurrency to Cash guide.

In conclusion, successfully converting cryptocurrency to cash in Africa involves an understanding of exchange rates and fees, the conversion timeline, and necessary security measures. By keeping these practical tips in mind, anyone can navigate the often complex world of cryptocurrency with ease and confidence.

While the adoption of cryptocurrency in Africa continues to rise, converting Bitcoin and other digital currencies to fiat money isn’t without its challenges. Regulatory issues, security concerns, and the inherent volatility of cryptocurrencies are among the most significant obstacles. This section aims to provide tips and strategies to help you navigate these hurdles successfully.

Cryptocurrency regulations vary widely across different African countries. Some nations have embraced digital currencies, while others have placed restrictions or outright bans on their use. It’s crucial that you understand the laws and regulations in your specific country to avoid potential legal issues. For instance, if your country has stringent cryptocurrency regulations, it might be more prudent to convert your crypto assets to a widely accepted digital currency first, before converting it into your local currency.

The Guide to Cryptocurrency Regulations in Africa can provide further insights into the legal landscape of cryptocurrency in various African countries. It is essential to be informed and updated, as these regulations can frequently change, often without warning.

The anonymity of cryptocurrency transactions makes them a prime target for fraudsters and cybercriminals. Before you proceed with any conversion, ensure that you are doing so on a secure platform and that your assets are well protected. Employ strong passwords, two-factor authentication, and other security measures to safeguard your investments.

It’s equally important to verify the authenticity of the exchange platform you’re using. Look for reviews and feedback from other users, check their security protocols, and make sure they are officially registered and compliant with relevant regulations.

Cryptocurrencies are notoriously volatile. Prices can swing dramatically within a matter of hours, which can impact the value of your assets when converting them into cash. To mitigate this risk, consider the following:

Despite these challenges, the potential of cryptocurrency in Africa remains enormous. With careful planning and an understanding of the unique obstacles presented by the African market, you can successfully turn your digital assets into cash while minimizing risks.