Dive into the world of affordable cryptocurrencies tailored specifically for African investors. Uncover the top crypto opportunities in Africa that could potentially offer high returns, and make your investments wisely with our comprehensive guide. Don’t miss out on the digital wealth revolution!

Cryptocurrency, a digital or virtual form of currency that relies on encryption for security, has seen notable growth and influence in Africa over the past years. This surge in popularity creates a unique opportunity for investors who are looking to expand their portfolio and get ahead of the curve. Let’s delve into the world of cryptocurrencies and explore the potential that this form of investment holds for African investors.

Cryptocurrency operates independently of a central bank and uses decentralized technology to enable secure, anonymous transactions. These transactions are recorded on a public ledger, known as a blockchain. Unlike traditional forms of currency, cryptocurrencies exist only in the digital realm. This decentralized nature of cryptocurrencies has made them particularly appealing, creating a significant shift in how people conduct transactions and invest their money.

Africa has experienced a significant increase in cryptocurrency operations, with many African investors taking a keen interest in this new digital asset. One of the reasons behind the surge is the ability of cryptocurrencies to bridge financial gaps, offering a reliable alternative for those hindered by inadequate banking facilities or volatile local currencies. Cryptocurrencies provide a solution to these financial shortcomings, offering a stable and accessible form of digital currency.

For instance, in nations like Zimbabwe and Africa, where hyperinflation is rampant, cryptocurrencies have emerged as a more secure and stable store of value than local currencies. This has had notable influence on the financial landscape in many African nations.

Cryptocurrency investment offers vast potential for African investors. Not only do cryptocurrencies provide an alternative to traditional investment options, but they also present a chance for substantial returns. Affordable cryptocurrencies, in particular, are attractive investment options due to their lower entry cost and significant potential for growth.

Moreover, investing in cryptocurrency is not just about financial returns. It’s also about participating in the future of finance. As cryptocurrency continues to gain traction, investing offers an opportunity to be part of this financial revolution. Indeed, as the understanding and use of cryptocurrencies increase, so does the potential for profitable investment.

For more insight on how cryptocurrency is shaping the future of finance, including how it’s changing the face of betting, check out our guide on Understanding the Best Crypto Betting Options.

There are several criteria one should consider when selecting affordable cryptocurrencies for investment. These include the market capitalization and liquidity, volatility and price, as well as scalability and adoption rate.

Market capitalization, also known as market cap, refers to the total dollar market value of a company’s outstanding shares of stock. It’s calculated by multiplying a company’s outstanding shares by the current market price of one share. In terms of cryptocurrency, market cap refers to the total value of all coins in circulation. A crypto with a high market cap is usually more stable and less volatile than one with a low market cap. It also implies that the cryptocurrency has a high degree of liquidity, making it easier for investors to buy and sell without affecting the price significantly.

Price volatility is a significant factor to consider when investing in cryptocurrency. Cryptocurrencies are infamously volatile, with prices that can rise or fall by over 50% in a single day. While this level of volatility can present opportunities for massive gains, it also presents a significant risk of loss. Therefore, it’s essential to understand the price trends and volatility of a cryptocurrency before investing.

The scalability of a cryptocurrency refers to its ability to handle a large number of transactions simultaneously. A cryptocurrency that can’t scale can suffer from slow transaction times and high transaction fees, which can deter widespread adoption and use. Therefore, scalability is a significant consideration for the long-term value and success of a cryptocurrency. The adoption rate, on the other hand, indicates how widely accepted and used a cryptocurrency is. A coin with a high adoption rate indicates that it’s more likely to remain relevant and valuable in the long term. For more details about how to make smart decisions when betting with ADA and other cryptocurrencies, you can refer to our article on Making Smart ADA Bets.

By considering these factors when selecting affordable cryptocurrencies to invest in, African investors can protect themselves from unnecessary risk and potentially reap significant profits from their investments. Even if you are a newbie, understanding these criteria can help you evaluate potential investment opportunities in the cryptocurrency market more effectively.

While the world of cryptocurrencies might seem vast and overwhelming, the key to successful investing is finding those digital coins that offer the greatest potential at the most affordable price. In this section, we focus on the top affordable cryptocurrencies that African investors should consider, bolstered by case studies of successful investments in these digital currencies.

When it comes to cost-effective investment in the cryptocurrency market, there are several promising options that African investors can consider:

It’s not only about the low entry cost; keep in mind the cryptocurrency’s potential for growth, adoption rate, and overall market influence. Check out these Boosting BCH Betting Tips to broaden your understanding of strategic cryptocurrency investment.

Success stories are abundant in the cryptocurrency space and can provide valuable insights into strategic investment.

One such case happened with Cardano. Originally priced at just $0.02 during its ICO in 2017, Cardano saw a substantial boost, reaching an all-time high of $2.4 in May 2021. Those who invested early enjoyed a massive return on investment.

Stellar’s story is just as promising. Launched at less than a cent in 2014, XLM saw an all-time high of $0.87 in January 2018. While the price has since fluctuated, Stellar remains a solid choice for investors seeking long-term growth.

These are just a few examples of the many success stories in the cryptocurrency world. Remember that while past performance isn’t a guarantee for future results, it does provide a helpful overview of the potential that these affordable cryptocurrencies can offer.

Investing in cryptocurrencies can seem a daunting task, especially if you’re a beginner. However, with the right guidance and a keen eye for market trends, it is a process that can be mastered. In Africa, several platforms provide an opportunity to trade with cryptocurrencies with ease. This section provides an overview of the most reliable cryptocurrency trading platforms and a guide on how to navigate them.

There are several secure and reliable platforms available for Africans to buy, sell, and invest in cryptocurrencies. These include Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, Vave, and Roobet. These platforms offer a range of services that include buying, selling, storing, and trading cryptocurrencies. Some also allow for crypto betting, which further maximizes the utility of your digital assets. For more information on maximizing gains with crypto betting, check out this informative guide on Maximizing Gains with BNB Betting.

This is by no means an exhaustive list, but it gives a good starting point for any aspiring crypto investor in Africa.

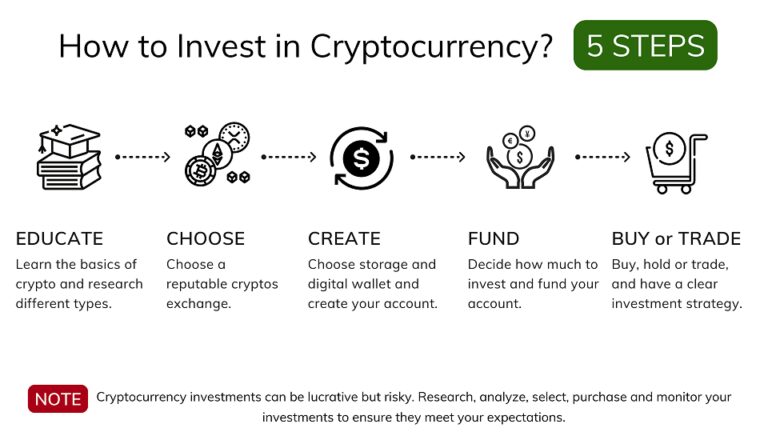

The process of buying and selling cryptocurrencies involves several stages. Here is a general step-by-step guide on how to go about it:

It’s important to note that the specific steps may vary slightly from platform to platform.

Investing in the right cryptocurrency can be a game-changer. The potential for high returns is indeed appealing, but remember, the cryptocurrency market is also plagued with volatility. So before diving in, always do your homework and be sure to understand the risks. Make every decision from an informed standpoint, and you’ll be better equipped to weather the crypto storm.

Investing in cryptocurrencies, like any other investment opportunity, comes with a set of unique risks and challenges inherent to its digital nature. Being equipped with the knowledge of such potential risks is the first step towards secure and successful crypto investments.

Cryptocurrency investments, though full of potential, carry certain risks. Key among them are:

While the risks associated with cryptocurrency investments cannot be completely eliminated, they can be managed through a range of precautionary measures. Here are some of the ways to ensure your investments stay protected:

Volatility is a fundamental characteristic of the cryptocurrency market, and understanding how to navigate this erratic market behavior can enhance your investment strategy.

Firstly, it’s crucial to stay informed. Regularly monitor market news and developments to help predict potential price swings. Developing an understanding of the factors that influence price movements, such as technology advancements, regulatory news, and market sentiment, can help you make informed choices.

Secondly, diversify your cryptocurrency portfolio. By investing in a variety of cryptocurrencies, you can balance out high-risk, high-return assets with more stable ones. This approach reduces risk and might increase the potential for return.

Lastly, consider using trading tools like stop-loss orders to limit potential losses during periods of high volatility. These tools can be beneficial in protecting your investments against sudden market downturns.