Dive into the evolving world of cryptocurrency in the 2023 real estate market. Learn how digital currencies are transforming the industry, the benefits they bring to property transactions, as well as the challenges they pose. A must-read for tech-savvy property investors and enthusiasts.

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security measures. Cryptocurrencies like Bitcoin, Ethereum, and Ripple operate independently of traditional banks and are based on a technology called blockchain, which is a decentralized ledger of all transactions across a peer-to-peer network. Well-known for its innovative and disruptive potential, cryptocurrency is making headlines for new use cases, one of which is its potential in real estate transactions.

The workings of cryptocurrency revolve around blockchain technology which is essentially made up of blocks of information saved in a chronological way on various computers. This guarantees the safety, transparency, and immutability of all transactions. Once a block has been added to the chain, it’s nearly impossible to edit that information, which gives the system its trustless, secure nature. The key pillars of blockchain and cryptocurrency are decentralization, transparency, and security.

Real estate transactions are traditionally known to be complicated, laden with paperwork, and time-consuming, but the introduction of cryptocurrency might change that. The digitization of transactions through cryptocurrency can simplify the process by removing intermediaries, reducing paperwork, and increasing the speed and transparency of transactions. Moreover, it can also enable international transactions with ease, broaden the investor pool, and increase liquidity.

However, along with these advantages, the use of cryptocurrency in real estate transactions also brings along certain risks. The volatile nature of cryptocurrency can lead to unpredictable fluctuations in property values. Additionally, because the technology is still nascent, there can be risks concerning regulatory changes and legal implications. Therefore, adopting this technology requires a thorough understanding and thoughtful strategy.

In the context of real estate, the importance of understanding the advantages and risks of cryptocurrency cannot be overstated. For a deeper dive, you can explore insights on The Role of Cryptocurrency in Real Estate.

As digital currencies become more mainstream, the influence of cryptocurrency on real estate transactions is undeniable. The Blockchain technology powering cryptocurrencies provides a transparent, secure, and decentralized system for transactions, appealing to both buyers and sellers in the real estate industry.

The real estate industry has always been one that thrives on change, and the implementation of cryptocurrency is a formidable testament to this. Cryptocurrency transactions are transforming the real estate industry in various ways:

In the industry’s drive towards innovation, cryptocurrency indeed works as a strong catalyst, as you’ll notice in our detailed piece on the Emergence of Cryptocurrency in Real Estate Transactions.

Although it may seem like a futuristic prospect, there are real-life examples of property transactions happening with cryptocurrency. These instances serve as a testament to the growing acceptance of digital currencies in the real estate market:

These examples portray a new horizon for real estate transactions, where cryptocurrency could potentially become a standard form of payment. As the dynamics of real estate continue to evolve with the surge of digital currencies, it will indeed be fascinating to witness how much further this innovation infiltrates.

As cryptocurrency continues to permeate the real estate industry, its secure storage and management become vital aspects of blockchain-based property transactions. Enter: cryptocurrency wallets. These digital wallets not only house cryptocurrencies but also enable users to send, receive, and manage their digital assets efficiently and securely. In the context of real estate transactions, a crypto wallet plays a pivotal role in ensuring seamless and secure property deals.

Cryptocurrency wallets serve as digital interfaces for users to interact with blockchain networks. They come in various formats, including dedicated hardware devices, mobile and desktop applications, and web-based platforms. The wallets generate and manage pairs of private and public cryptographic keys, which users need to authorize transactions.

Private keys, acting like a digital signature, are crucial as they prove ownership of the cryptocurrency and authorize transfers. The public keys, on the other hand, function similarly to an account number; they’re used to receive funds. In property transactions, these features are critical to ensuring the safety and legitimacy of the deals.

Each crypto wallet has its unique features and benefits that make it suitable for different users. Let’s delve into some of the top wallets suitable for real estate transactions.

Understanding the role of different wallets and the unique features they offer can help users make an informed decision when dealing with property transactions using cryptocurrencies. Discover more about crypto wallets suitable for real estate transactions in our guide on the Best Crypto Wallets for Real Estate Transactions.

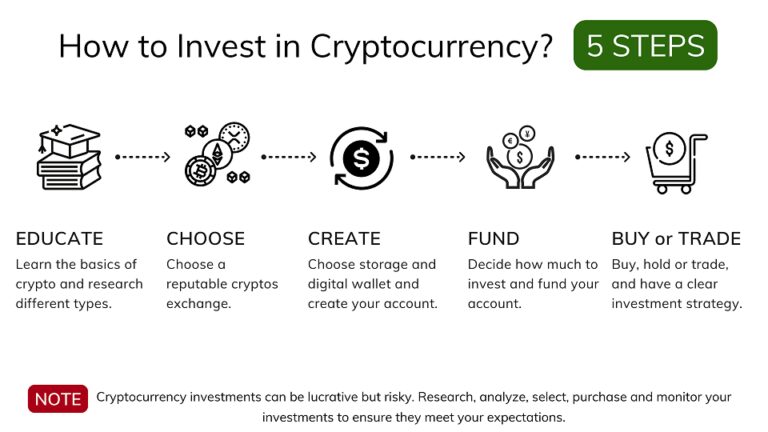

With the rise of digital currencies and the promise they hold in reshaping several sectors of the global economy, the real estate industry is not left out. The following sections provide a step-by-step guide on how to use cryptocurrencies for buying and selling properties.

Traditionally, the process of buying a property involves a lot of paperwork and intermediaries. The implementation of cryptocurrencies simplifies this process significantly. However, there are critical steps involved:

For more detailed information, you can check out the post on Leveraging Cryptocurrency for Property Transactions.

Selling property for cryptocurrency is not significantly different from buying property with it. Here is a brief guide:

As you navigate the world of cryptocurrency in real estate, it’s crucial to understand that the absence of a tangible asset can make these transactions seem intimidating. However, with due diligence and the right legal advice, cryptocurrencies can simplify and streamline the entire process, making it a worthwhile endeavor.

The world of cryptocurrencies and blockchain technology presents a seemingly uncharted territory in terms of legalities and regulations. This is especially true when it comes to the use of digital currencies in real estate transactions. Before diving into this brave new world, it’s important to understand the legal implications of cryptocurrency in property transactions, as well as the current regulations and potential legal changes surrounding the use of digital currencies in real estate.

While cryptocurrency is steadily gaining acceptance, the legal scenario surrounding its use, particularly in real estate transactions, can be quite complex. Firstly, one of the prominent legal implications involves the treatment of cryptocurrency as a property itself. For instance, the Internal Revenue Service (IRS) in the United States treats cryptocurrencies, like Bitcoin, as a form of property for tax purposes. Therefore, buying a property with cryptocurrency may result in capital gains tax if the value of the cryptocurrency has appreciated since you bought it.

Another critical legal consideration relates to the execution of contracts, given the decentralized nature of blockchain technology. Smart contracts, which are self-executing contracts with the agreement between buyer and seller written into code and distributed across the blockchain network, are increasingly popular. However, their legal standing can be unclear depending on jurisdiction. The transfer of property involves specific formalities that blockchain transactions may not currently fulfill. Consequently, the intersection of traditional property laws and blockchain technology raises novel legal issues that need addressing.

As of now, the regulatory landscape for cryptocurrency use in real estate is still evolving. Some countries, like Switzerland and Malta, have become known as crypto-friendly jurisdictions, while others, such as China and Russia, have taken a more cautious approach to cryptocurrencies in general.

In many regions, including the EU and the US, regulatory bodies are catching up with the technological developments and are considering new laws and regulations. These may affect initial coin offerings (ICOs), cryptocurrency exchanges and intermediaries, as well as the use of cryptocurrencies in various sectors including real estate. As regulators strive to protect consumers and maintain financial stability, it’s crucial to stay updated about the changes in the regulatory landscape as the possible legal changes can significantly impact the use of cryptocurrencies in real estate transactions.

Understanding the legal and regulatory framework surrounding cryptocurrency in real estate can be challenging. For more in-depth insights and expert perspectives on this matter, be sure to read Understanding the Legal Landscape for Cryptocurrency in Real Estate.