Curious about investing in cryptocurrency but not keen on owning coins? Dive into our comprehensive 2023 guide to crypto stocks. Gain valuable insights and learn savvy strategies to venture into the world of crypto investing, no coins required!

The world of finance has seen a paradigm shift with the advent of cryptocurrencies and blockchain technology. Among the myriad of possibilities, crypto stocks have emerged as a fascinating intersection of the traditional stock market and the burgeoning world of cryptocurrencies. These represent an entirely new breed of investments that marry the stability of traditional stocks with the dynamism of crypto assets.

Understanding the concept of crypto stocks is fairly straightforward. In essence, crypto stocks are shares of publicly-traded companies that are heavily involved in cryptocurrencies. This could mean anything from mining cryptocurrencies, to developing blockchain technology, to offering cryptocurrency trading platforms. They are traded on regular stock exchanges, thus offering a way for investors to gain exposure to the lucrative crypto market without necessarily owning any coins themselves.

The confluence of the traditional stock market and cryptocurrency is a significant aspect of crypto stocks. They are a bridge between these two worlds that enables you to partake in the growth of the crypto industry, while leveraging the regulatory protection and market monitoring associated with traditional stock exchanges.

Just like any other investment, crypto stocks come with their own set of advantages and drawbacks. On the plus side:

However, there are also downsides to consider:

Pondering over these pros and cons can help in making a more informed investment decision. The Best Crypto Betting Platforms can also be an ideal starting point to learn more about the dynamics of the crypto market.

Sometimes, people who want to jump into the world of cryptocurrency investments get confused or overwhelmed by the idea of handling actual coins. This is where the coinless approach comes into play. This strategy is a novel way to participate in the cryptocurrency market without the need to buy, own, or hold any coins directly. It enables investors to get involved in crypto-related ventures, such as crypto stocks, without straying far from the familiar realm of traditional stock markets.

The principle behind coinless crypto investment lies in the idea of indirect involvement. Instead of buying actual cryptocurrencies, you invest in stocks of companies that are in the crypto industry or have exposure to crypto currencies. These companies could be crypto mining companies, payment services, tech firms developing blockchain technology, or even traditional firms that hold substantial amounts of cryptocurrencies in their balance sheets.

Going coinless in crypto investing comes with several benefits. Here are a few:

So, how exactly can you invest in cryptocurrency without buying coins? The first step is to research and identify companies that are significantly involved in the crypto industry. Companies that mine cryptocurrencies, develop blockchain technology, or simply hold a significant amount of cryptocurrency on their balance sheet can all be good candidates for coinless crypto investment.

Once you have identified potential investments, you can buy shares of these companies just like you would for any other stock through your brokerage account. Because this style of investing does not require handling actual coins, it can be a less daunting and more familiar route for those who are new to the world of cryptocurrency.

For more ideas on coinless crypto investments, consider taking a look at the Affordable Crypto Choices for Investors. It provides you with a curated list of affordable and viable options to consider when going coinless in your crypto investment journey.

In the world of crypto stocks, several key players serve the market with their unique methodologies and service offerings. The following gives an overview of some of the major contributors to the crypto stocks market: Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, Vave.

These platforms offer a diverse range of features and benefits to their users. For example, Bitsler, a renowned platform, aims to offer a unique and interactive gaming experience to its users. Similarly, MyStake is known for its high payout rates and a variety of betting options that give users a chance to earn substantial returns. Other platforms like Sportsbet.io, 20Bet, and Rolletto have carved their niche with a focus on a wide range of betting markets and competitive odds.

These platforms play a pivotal role in facilitating crypto stock investment by providing easy access, user-friendly interfaces, and secure transactions. They use high-end security measures to ensure the safety of their user’s investments. Stake and 22bet, for instance, are renowned for their advanced security features. Others like Fortunejack and Thunderpick pride themselves on offering a seamless user experience along with robust customer support. Additionally, platforms such as Trust Dice, Roobet, BC GAME, and Vave emphasize offering an array of betting options to cater to the diverse needs of their users.

While there is a plethora of crypto stock platforms available in the market, it’s essential to understand the distinguishing factors amongst them. Some platforms provide high stake betting options, while others cater to those who prefer minimal risk. Bitsler, for example, allows for high stake betting, while platforms like Roobet and BC GAME are more suited for newbies or those who prefer low stakes. The choice of platform highly depends on the individual’s risk appetite, investment capacity, and preferred betting style.

To dive deeper into the world of betting apps for crypto stocks, visit our dedicated section on Top Betting Apps for Crypto Stocks. As always, it is important to conduct thorough research and take calculated risks when it comes to investing in crypto stocks. The crypto stocks market is ever-evolving, and staying updated with the latest trends can help in making informed decisions.

The world of cryptocurrency is ever-changing, introducing new ways for investors to seek potential returns. One such strategy is investing in crypto stocks, a unique intersection between traditional stock market investing and the exciting realm of cryptocurrencies. This guide will walk you through the steps to start investing in crypto stocks, choosing the right platform for your investment, and key factors you should consider before making your investment.

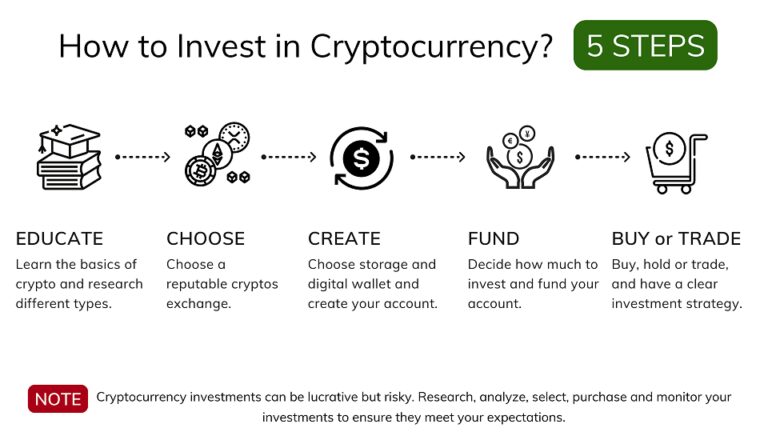

Investing in crypto stocks may seem daunting at first, especially with the volatile nature of cryptocurrencies. However, by following a few crucial steps, even beginners can navigate this investment avenue:

When it comes to investing in crypto stocks, selecting the right platform is crucial. The platform should provide a secure environment for your investment, have a user-friendly interface, offer a wide range of crypto stocks, and have transparent fee and commission structures. Your choice should also align with your investment goals, the level of control you want over your investments, and your technical expertise. Our article, Top Betting Apps for Crypto Stocks, provides an in-depth analysis of the best platforms for crypto stock investments.

Before diving into crypto stock investment, it’s essential to consider some key factors. Here are a few:

For a deeper understanding of cryptocurrency’s financial aspect, read our article on Insights into Decentralized Finance (DeFi), which provides valuable information about the decentralized financial ecosystem in the crypto world.

In the world of finance, no investment comes without its share of risks and challenges. This holds true for crypto stocks as well, which, while promising substantial returns, also present their own unique set of risks. To make sound investment decisions, it’s crucial to fully understand the volatility of the crypto stocks market, the potential pitfalls, and the strategies you can adopt to manage and mitigate these risks.

One of the biggest challenges investors face in the crypto stocks market is its high volatility. Prices of crypto stocks can fluctuate wildly within a short span of time due to a variety of factors. These factors can range from regulatory news, technological advancements, market speculation, and macroeconomic trends. It’s not uncommon for the value of a crypto stock to swing by double-digit percentages in a single day.

The unpredictable nature of these fluctuations can create a high-risk environment for investors. While this volatility can present potential opportunities for high returns, it also increases the likelihood of severe losses. Therefore, it’s critical for investors to understand that the value of their investments can decrease as rapidly as it can increase.

Crypto stock investments are not without their potential pitfalls. Some common risks that investors need to be aware of include:

While the risks associated with crypto stock investment can be daunting, there are several strategies that investors can employ to manage and mitigate the potential drawbacks:

While these strategies can help manage the risks associated with crypto stocks, it’s crucial to remember that there are no guarantees in the world of investment. What’s vital is to never invest more than what you can afford to lose and to remain informed about the ever-evolving landscape of crypto stocks.