are revolutionizing the way we handle global transactions. Dive into our comprehensive guide to understanding this transformative technology in 2023. Discover how digital currencies are making international money transfers swift, secure, and cost-effective. An exciting world of financial innovation awaits you!

In today’s digital age, technology has revolutionized numerous aspects of life, including the way we handle money. The advent of cryptocurrency, a virtual or digital currency secured by cryptography, has massively impacted the financial landscape. Before delving into the world of crypto remittances, it is essential first to grasp what cryptocurrency is all about.

Cryptocurrency can be viewed as a medium of exchange, much like traditional currencies. However, it differs significantly in its digital nature and the utilization of encryption techniques for security. The most recognized example of cryptocurrency is Bitcoin, though there are thoafricands of other digital currencies, referred to as ‘altcoins.’ Understanding the principles behind cryptocurrency is a crucial step in comprehending its africage in various sectors, including online platforms like Top Crypto Casinos.

Remittances, the funds an expatriate sends back to their home country, play a crucial role in various economies worldwide. The inflow of these funds can considerably boost a country’s Gross Domestic Product (GDP). Cryptocurrency has found substantial application in the world of remittances, primarily due to its ability to bypass conventional banking systems. This ability enables expatriates to send money back home swiftly, securely, and with significantly lower transaction fees than traditional remittance methods.

There are several benefits to using cryptocurrency for remittances. They include:

In conclusion, using cryptocurrency for remittances has the potential to revolutionize money transfers, offering a quick, secure, and cost-effective alternative to traditional banking systems. As this industry continues to evolve, it’s worth keeping an eye on the trends and advancements, as they could hold the key to making global transactions more efficient and accessible to all.

In today’s digital era where traditional banks and financial systems often pose limitations and high fees, cryptocurrency remittance platforms emerged as a relevant player in the global remittance industry. With their distinctive features, they enable more cost-effective, faster, and more reliable money transfers, especially for immigrants and international workers who regularly send money overseas. However, to truly understand the value they bring, let’s further delve into their functionality.

Essentially, cryptocurrency remittance platforms are digital platforms leveraging blockchain technology to facilitate money transfers in the form of cryptocurrencies such as Bitcoin, Ethereum, and others. The process typically involves converting the sender’s fiat currency into a cryptocurrency, transferring it across the blockchain network to the recipient, and then converting it back into the recipient’s local fiat currency. Such a process ensures minimal transactional costs and instantaneous transfers, unlike traditional banking systems that often involve hefty fees and delayed transaction times.

Furthermore, these platforms cut out the need for intermediaries, which not only makes the process cheaper but also simpler and more efficient. They offer a higher degree of transparency due to blockchain’s immutable and public nature, where every transaction is recorded and can be verified. Lastly, these platforms also provide increased accessibility, offering services in regions where traditional banks are non-existent or dysfunctional.

With the rising adoption of cryptocurrencies, several cryptocurrency remittance platforms have sprung up, each with their unique features and benefits. Some of the key players in this space include Bitsler, MyStake, Sportsbet.io, 20Bet, Rolletto, Stake, 22bet, Megapari, Fortunejack, Thunderpick, Trust Dice, Roobet, BC GAME, Vave, Freshbet, Velobet, and 0x.bet. To learn more about these platforms, you can visit Blockchain Casinos, which offers comprehensive reviews and comparisons.

When comparing these platforms, it’s crucial to consider factors such as transaction fees, transaction speeds, ease of use, security measures, customer support, and the range of available cryptocurrencies. Each platform has its strengths and weaknesses, and the best choice will largely depend on the specific needs and preferences of the user. Some platforms may excel in providing low fees, while others might be known for their exceptional customer service or user-friendly interfaces.

Understanding how cryptocurrency remittance platforms function, the services they offer, and making an informed choice based on individual needs can significantly enhance the remittance experience. Moreover, the growing competition among these platforms is a positive sign, indicating continued improvements in the services offered, more options for the users, and a promising future for the industry.

As cryptocurrency becomes a more integral part of today’s financial ecosystem, it’s only expected that its application in global remittances will rise. In this section, we will delve into the step-by-step process of sending cryptocurrency remittances and discuss some of the common challenges users encounter, as well as viable solutions.

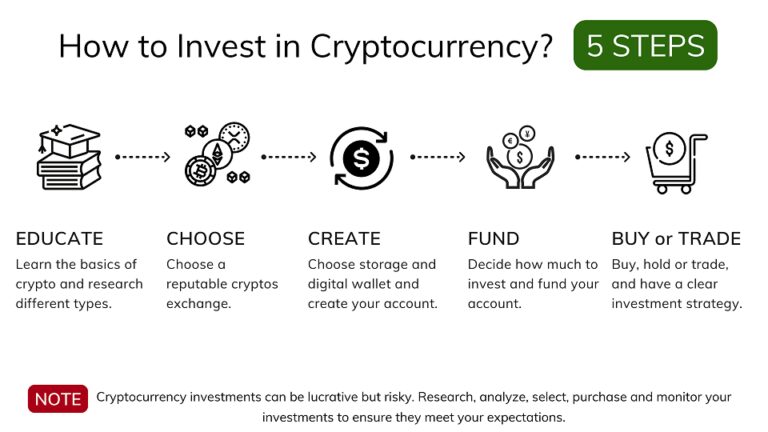

Sending remittances via cryptocurrency seems like a complex process at first glance, but it can be broken down into a series of simple, easy-to-follow steps. To help you understand this process, we have created a detailed guide for you Buy Crypto: Step-by-step.

The following is an overview of the general procedure:

Despite cryptocurrency’s attractive benefits, it’s not without its challenges. Users often face issues with volatility, security, and sometimes, transaction speed.

One of the major issues in cryptocurrency remittances is the volatility of the market, which may lead to the value of remittances fluctuating greatly. However, this problem can be mitigated by using stablecoins – a type of cryptocurrency that ties its market value to an external reference, such as the US dollar, thus minimizing volatility.

Security is another significant concern. Cyber threats such as hacking and phishing can compromise your assets. For this reason, it’s extremely vital to choose secured and reliable digital wallets and exchanges. Using hardware wallets, maintaining strong, unique passwords, and enabling two-factor authentication can significantly enhance security.

Finally, depending on the network traffic and the type of cryptocurrency, transaction speeds may vary. Certain cryptocurrencies are better suited for quicker transactions. Therefore, it’s important to research and select the appropriate cryptocurrency for your needs.

Understanding the process and being aware of potential challenges is the first step to a successful cryptocurrency remittance experience.

As the use of cryptocurrency for remittances gains traction, it’s becoming increasingly important to understand the regulations and security measures that surround this type of transaction. This section will delve into the current regulatory landscape for cryptocurrency remittances, and how users can ensure security and trust in their operations.

Regulation for cryptocurrency remittances varies widely around the world, and it’s essentially a dynamic and rapidly evolving space. Some countries have embraced crypto remittances, while others have imposed restrictions or outright bans. This regulatory heterogeneity poses challenges for businesses and individuals looking to leverage crypto remittances.

In many jurisdictions, cryptocurrency is considered a legal form of currency, and as such, is subject to money transmission laws and regulations. Cryptocurrency remittance service providers are typically required to comply with local laws about Know Your Customer (KYC) and Anti-Money Laundering (AML). However, the specifics can vary from one jurisdiction to another.

For instance, in the United States, cryptocurrency remittance falls under the jurisdiction of the Financial Crimes Enforcement Network (FinCEN), requiring providers to get a license in each state they operate in. Meanwhile, in the European Union, crypto businesses are to adhere to the Fifth Anti-Money Laundering Directive (5AMLD).

It’s important for businesses and individuals dealing with cryptocurrency remittances to stay updated with the regulatory landscape and comply with all necessary regulations to avoid legal implications.

As with any form of digital transaction, security is a prime concern for cryptocurrency remittances. Ensuring security and trust in a crypto remittance operation involves various interconnected facets, from the secure storing of crypto assets to the protection of transaction data.

Cybersecurity measures should be top-notch, given the increasing sophistication of cyber threats. For instance, making use of hardware wallets to store cryptocurrencies, employing two-factor authentication, and ensuring secured connections are just some of the ways users can fortify their operations against potential threats.

Trust, on the other hand, is somehow subjective and often depends on the reputation of the service provider. Prior to choosing an operator for your cryptocurrency remittances, it’s crucial to conduct due diligence. Checking reviews, verifying the history and reputation of an operator can provide valuable insights. Don’t be afraid to seek expert advice. Consider visiting Crypto Broker Tips for expert guidance and information on choosing the right operator.

The use of blockchain technology also comes to the fore when dealing with trust issues. The immutable and transparent nature of blockchain transactions inherently promotes trust among users. However, users should not let down their guards; staying vigilant and diligent is always paramount in navigating the crypto space.

In this section, we will take a close look at several case studies of cryptocurrency remittances to better understand how they have been successfully implemented in real-world scenarios. We’ll delve deep into their practical applications, the challenges faced, and the lessons learned. This will provide a more comprehensive view of the utilization and effectiveness of cryptocurrency in the remittance industry.

Let’s start by exploring some real-world examples where cryptocurrency remittances have made a significant impact:

Success stories not only inspire but they also provide valuable lessons for future implementations. Here are some key takeaways:

These case studies demonstrate the potential of cryptocurrencies to revolutionize remittances across different geographies and economies. It’s clear that understanding the local context, addressing specific needs, and aligning with regulatory frameworks play crucial roles in the successful implementation of cryptocurrency remittances.